Research that Enables More Effective Stewardship

For Northern Trust, stewardship means making decisions today that deliver lasting value for clients.

Glass Lewis supports that mission with independent research, grounded in local expertise and a global perspective. With insights from more than 200 regional specialists, we cut through complexity to help investors make more well-informed decisions.

Why Glass Lewis?

20+

Years of Governance Leadership

200+

Regional Analysts Fluent in 30+ Languages

1500+

Company Engagement Meetings

30,500+

Shareholder Meetings in 100+ Markets

140+

Controversy Alerts

3,000

Issuer Data Reports

270+

Report Feedback Statements

~19

Days for Research Delivery Lead Time

Alignment with Northern Trust’s Principles

The following proxy research reports illustrate how Glass Lewis’ insights can advance Northern Trust’s stewardship program. Each example highlights how nuanced, context-rich analysis helps inform decision-making on governance practices, environmental and social risks, and performance.

Risk Oversight

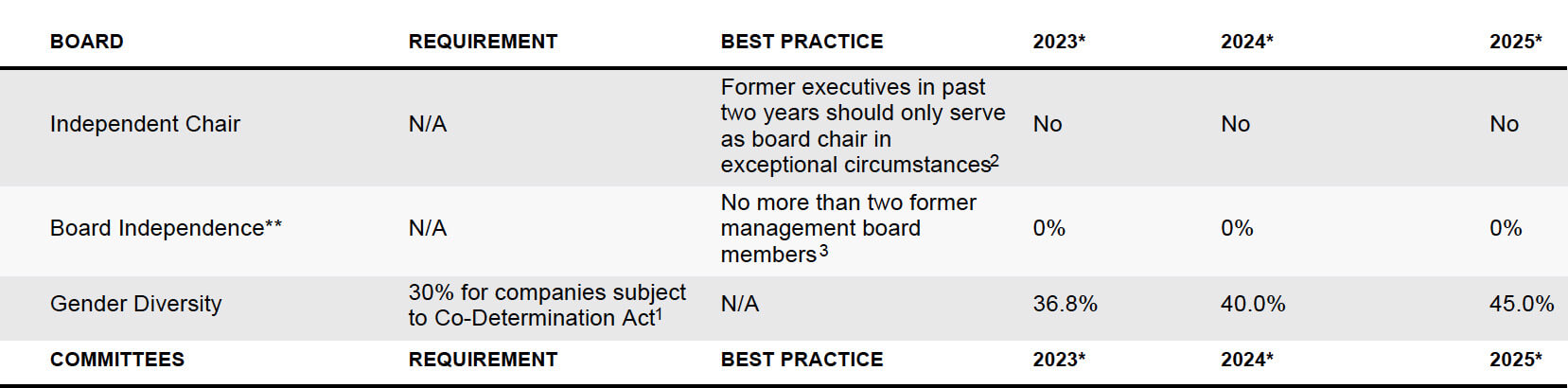

Volkswagen AG

Analysis of supervisory board accountability, data illustrating lack of director independence, and a summary of ongoing investigations provide insight into the impact of persistent governance concerns.

Download Volkswagen Report

Meta Platforms

At-a-glance board accountability data combined with a detailed examination of director independence helps in assessing governance standards and oversight structures.

Download Meta Platforms Report

Environmental and Social Risks

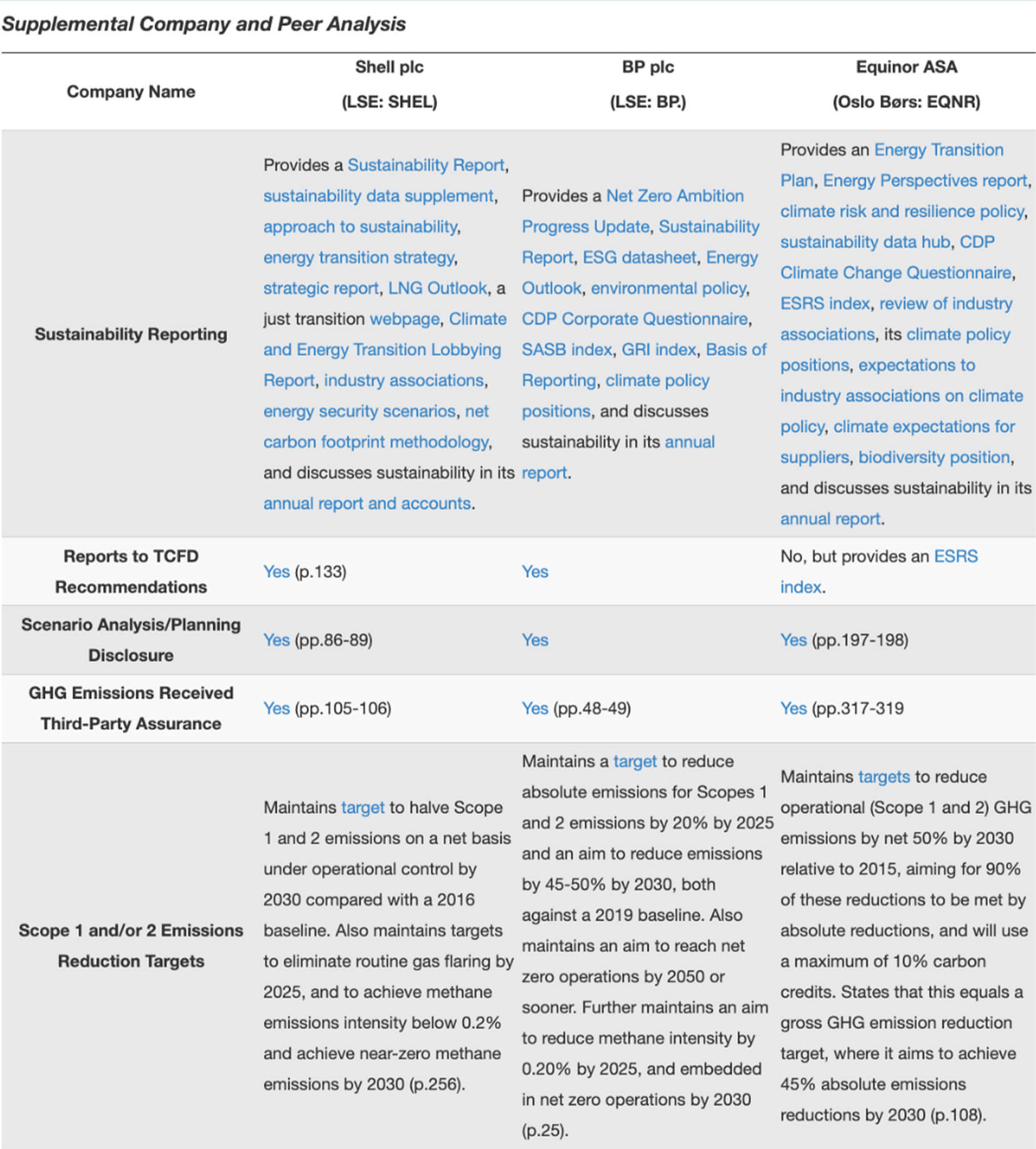

Shell plc

Comprehensive overview of the company’s climate targets and reporting provides a contextual, peer-based perspective on the necessity of a shareholder resolution calling for additional disclosures.

Download Shell Report

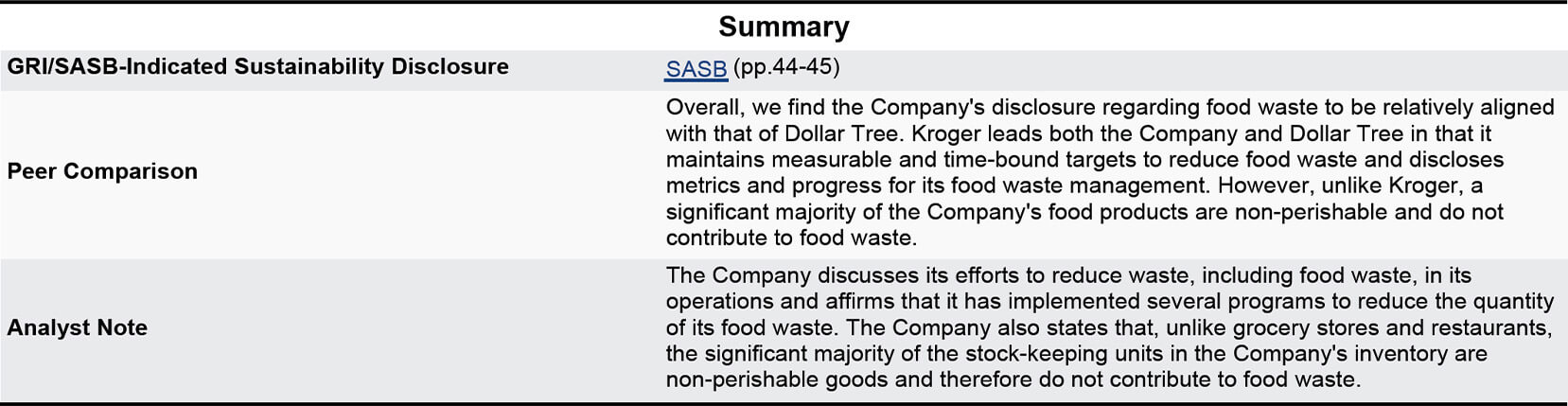

Dollar General

With growth tempered by labor and safety controversies, and multiple E&S proposals on the ballot, our in-depth analysis summarized at-a-glance helps investors quickly identify which issues do (and don’t) warrant direct action.

Download Dollar General Report

Board Composition

Premium Brands Corporation

A unique restriction on shareholders’ ability to vote on shareholder proposals presents a dilemma for investors and raises concerns about Board and Nominating/Governance Committee effectiveness.

Download Premium Brands Report

Samsung Electronics

Assess how conflicts of interest and ongoing liabilities impact governance and corporate performance with extensive background on related party transactions historical scandals.

Download Samsung Electronics ReportExecutive Compensation

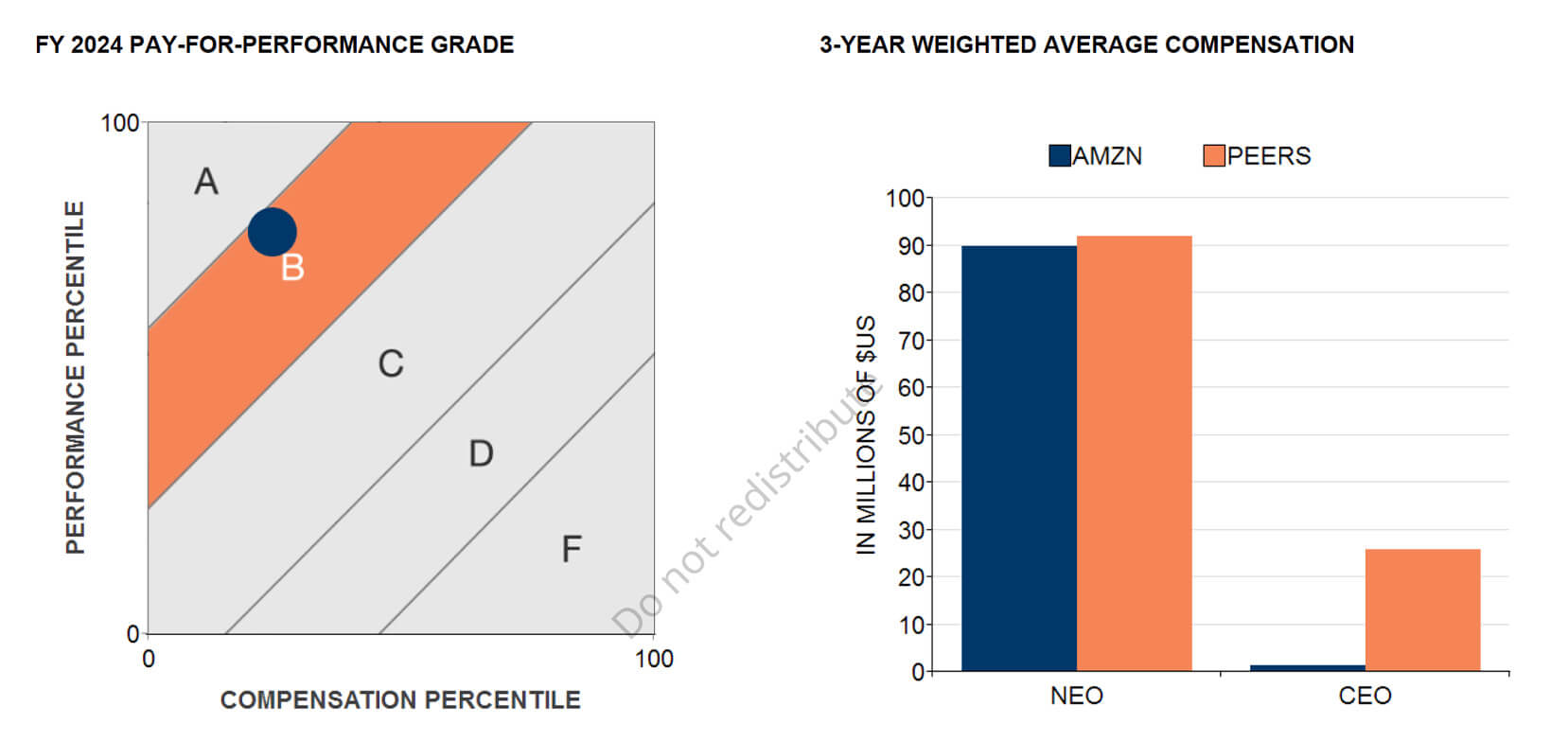

Amazon

The company’s unique and much debated incentive structure shows reasonable alignment between pay and performance in our proprietary model and our case-by-case analysis.

Download Amazon Report

Dassault Systèmes

Thorough but digestible summary of the executive compensation program, and analysis that goes beyond pay proposals, connecting the dots to pay governance oversight and board responsiveness.

Download Dassault Systèmes ReportComing Soon!

Glass Lewis’ new pay-for-performance methodology will be integrated into our corporate governance research beginning in 2026.

The framework offers a holistic, multifactor score (0–100) and an associated concern level for each covered company, ranging from negligible to severe.

The framework offers a holistic, multifactor score (0–100) and an associated concern level for each covered company, ranging from negligible to severe.

Key updates to the methodology include:

Multi-Test Scorecard

Six distinct tests for North America and five for Europe and the UK, designed to evaluate pay alignment from multiple angles.

Five-Year Measurement Horizon

Extends the lookback period from three to five years to better capture long-term performance.

Peer Expansion

Expands existing peer selection methodology to additional markets and introduces market cap bands and benchmarks, resulting in better global alignment in peer approaches.

Multi-Test Scorecard

Six distinct tests for North America and five for Europe and the UK, designed to evaluate pay alignment from multiple angles.

Contested Situations

When stakes are high, our independent, nuanced research insights offer investors a distinct perspective — as seen in complex situations at Phillips 66 and Harley-Davidson.

Harley-Davidson (Vote No)

Recommendations against management’s slate reflect entrenched governance issues and the need for fresh perspectives.

Download Harley-Davidson Report

Phillips 66 (Contested)

Support for independent nominees with relevant expertise highlights how board change can strengthen accountability.

Download Phillips 66 Report

Collaborating with Northern Trust for Long-Term Value Creation

Glass Lewis research is rigorous, contextual, and actionable — built to strengthen stewardship programs and support long-term value creation.

Let’s Continue the Conversation