.png)

Key Takeaways

For institutional investors, the end of proxy season marks a significant turning point. Investment and stewardship teams shift to evaluating vote outcomes, refining policies, and preparing for deeper engagement with their portfolio companies.

While this period can be complex, it also presents an opportunity to uncover insights that can sharpen stewardship strategies and strengthen relationships with stakeholders. Partnering with an experienced stewardship provider can enable teams to elevate governance practices, reinforce leadership in stewardship, and build long-term value.

Bringing Clarity to Voting Workflows

When questions arise from stakeholders post-season, having a clear view of portfolio-wide trends – and how specific voting decisions align with policy and strategy – can strengthen those conversations.

A robust voting rationale framework not only supports reporting but also demonstrates alignment and creates a durable record. Increasingly, investors are embedding the process of capturing vote rationales into their workflow, making it an integral part of stewardship.

Glass Lewis’ Viewpoint platform is designed to provide transparency across the voting workflow. The platform supports more efficient, informed decisions, and tracks each vote – and the rationale behind it – for easy reference and enhanced post-season analysis and reporting.

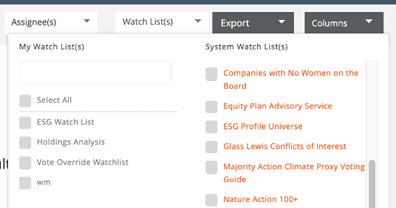

Watch Lists are one of the tools within Viewpoint that enable investors to filter, sort, analyze and export upcoming and historical voting activity. Investors can receive alerts for companies with special voting instructions, draw from a library of pre-set lists tracking notable votes — such as PRI-signatory resolutions — or create their own tailored lists.

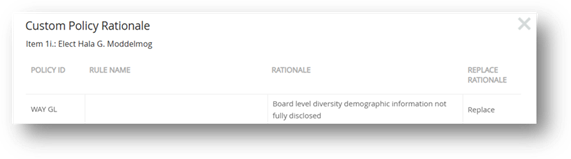

Viewpoint also helps to document decisions by prompting users to provide voting rationales when casting votes for or against management or policy, and alerting users when information is missing. Proxy voting teams can also create a custom library of pre-defined rationales to strengthen voting consistency across their organization and better support post-season analysis.

These capabilities streamline proxy voting and enhance reporting, empowering investors to communicate not just their vote results but also how they align with stewardship strategy.

Aligning Policy and Practice

Examining vote outcomes post-season can reveal where results diverged from intentions. Identifying these patterns provides an opportunity to demonstrate stewardship rigor.

Many investors now use the post-season to model how past votes might have played out under revised criteria — insights that help refine policies before the next season. Glass Lewis’ Custom Policy team supports this process with “what-if” hypothetical scenario testing, providing concrete data to fine-tune policies and enhance engagement efforts ahead of next season.

Bridging Voting and Engagement

Traditionally, voting and engagement decisions were managed by different teams. Today, many firms are shifting toward greater integration, aligning their stewardship efforts and presenting a more unified narrative..

Centralizing this information in one platform not only streamlines workflows but also provides a clearer picture of how decisions are made — bolstering the story investors share with stakeholders. The Engagement Management Platform imports voting data from Viewpoint or other proxy voting platforms and links vote decisions with engagement records — all within a single environment.

Read more: Bridging the Gap: Integrating Proxy Voting and Engagement

Transparency Made Simple

As regulatory and client expectations rise, so does the demand for timely, dynamic, and user-friendly reporting on proxy voting. Meeting these expectations can be easier with the right tools.

Glass Lewis’ Vote Disclosure service automates this process, publishing historical and current vote records – including vote rationale – to a secure, branded website. This allows investment and stewardship teams to focus less on operational logistics and more time on analyzing data, engaging with stakeholders, and refining strategy.

Navigating Change With the Right Partner

Some firms question whether switching providers will disrupt their processes. In practice, with the right support, transitioning can be straightforward and efficient.

Glass Lewis’ dedicated Client Services team provides guidance during each step of onboarding, ensuring a smooth process that typically takes less than a month. Many firms find that making the switch delivers not only continuity but also greater clarity, control, and confidence in their stewardship operations.

Watch: Why Switching to Glass Lewis is Seamless

Elevate Your Voting Process This Post-Season

The post-season is a chance to set the tone for the year ahead — whether by strengthening data management and analysis, testing policy updates, or unifying engagement and voting records.

At Glass Lewis, we work alongside investors to make the most of this stage, helping enhance stewardship strategies and prepare for what’s next.

Next month, we’ll explore how our custom engagement services and custom voting policies can help align engagement and voting priorities even more effectively.