The tools and insights you need to confidently manage your stewardship programs

Rely on our Proxy Paper for the data, research, and insights to make educated voting decisions based on decades of experience in the proxy voting industry. Our proxy research includes a wide range of information including ESG data, compensation data, board details, and highly nuanced custom analysis provided by our seasoned team of research analysts and issue specialists.

Global Analyst Teams

Wherever you are, we’re most likely right there with you. Our expert research and analyst team is spread around the world providing in-depth proxy research to more than 100 markets.

Local Market Expertise

Every market is unique and requires a unique approach. Our expert regional analysts collaborate with subject matter experts in local market laws, regulations, and best practices.

Custom Coversheets

Our tailored coversheets include custom policy recommendations and rationales to make it easier to quickly determine important insights without scrolling through pages of research.

Advanced Lead Time

Get extra time to review your Proxy Paper research. Glass Lewis has the largest lead time in the industry so you get your Proxy Paper weeks before anyone else.

Wide Coverage Range

We’ve got you covered! Research areas include M&A, Board of Directors, Executive Compensation, Shareholder Proposals, Cybersecurity, SASB Materiality, and more.

Flexible Delivery Methods

Your Proxy Paper research reports are available through multiple delivery methods, including our voting software Viewpoint, SFTP, email, and more.

Thoughtful, detailed features to save you time during proxy season

With the Glass Lewis Proxy Paper, you get a time-saving, transparent report to keep you compliant with guidelines and global regulations that enables you to make decisions, recommendations, and votes.

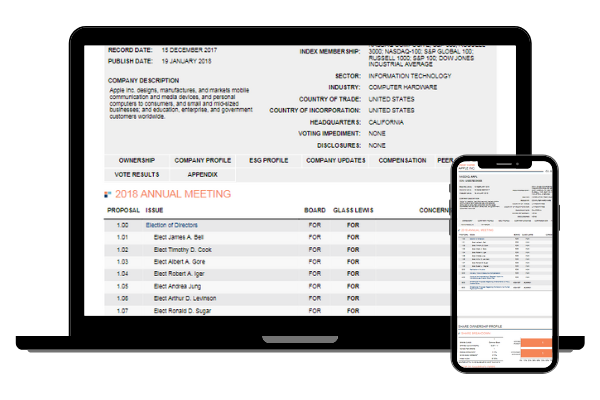

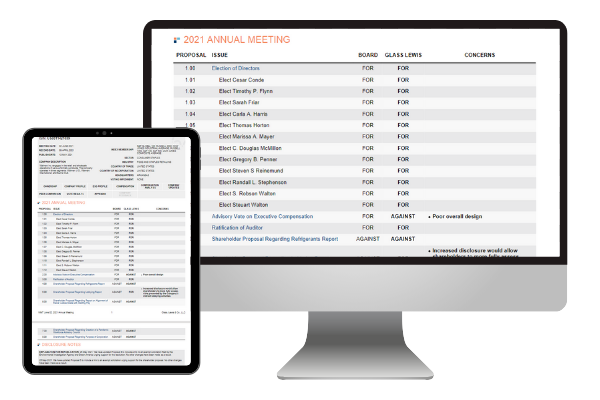

Save time with a quick, clean overview page

Each proxy paper begins with an overview page showing you high-level, linked agenda items and recommendations saving you hours of time you’d otherwise be spending scrolling through a massive report.

Navigate recommendations and data with ease

You don’t have time to get lost in research and reports so we build our Proxy Paper to be easy to navigate and read. Eliminate frustration with our cohesive, streamlined Proxy Paper report, with its digestible overview page that naturally flows into quick, contextual pages of insights and analysis.

Gain a deeper understanding of agenda items

Get more insights and background information into each issue on the ballot with contextual pages giving you a peek into the data and analysis. Each agenda item analysis page is linked from the overview page for quick review and reference.

Get relevant and timely ESG data

With the Glass Lewis ESG Profile, you get timely, transparent ESG data that supports your decisions, recommendations, and votes. Data is collected and clearly presented in the lead up to a company’s AGM so you can always vote with assurance.

Valuable data and insights through our strategic partnerships

We’ve partnered with leaders in ESG and cybersecurity to leverage their expertise and data in our Proxy Paper reports, giving you additional insights to make more informed decisions.

ESG Book* Sustainable

Performance Ratings

Pivotal sustainability, social, and governance intelligence included with Glass Lewis Proxy Paper reports allows you to access the latest ESG data and insights to enable ESG-driven proxy voting decisions. (*Formerly Arabesque)

BitSight Cyber Risk

Security Ratings

Critical cybersecurity information from our partner, Bitsight, included with Glass Lewis Proxy Paper reports helps you understand how cybersecurity issues may impact governance risks.

Sustainalytics

ESG Insights

Summary data and insights from our partners, Systainalytics, included with our Proxy Paper reports to effectively align proxy voting and engagement practices with ESG risk management considerations.

All your stewardship needs in one place

We’ve got everything you need to confidently manage your investments, from proxy research and voting to share recall, and all the little details in between.

ESG Controversy Alert

Have the confidence of never missing the most material meetings and votes. Our Controversy Alert highlights potential material ESG risks identified at annual shareholder meetings across the globe.

Active Ownership Engagement

Leverage the over 1,500 engagement meetings that Glass Lewis’ holds annually across 100+ markets globally to advance your stewardship activities.

Viewpoint Proxy Voting Platform

Viewpoint, our proxy voting software, is ready to meet your fast-changing and increasingly complex requirements, offering the most flexible and user-friendly interface on the market.