Recent updates have eased the recommended limits on UK public companies seeking to issue new equity without first offering it to existing shareholders, thrusting a routinely requested authority into the limelight. With the UK’s 2023 proxy season now complete, we’ve observed a decrease in average shareholder support for these proposals.

Recent updates have eased the recommended limits on UK public companies seeking to issue new equity without first offering it to existing shareholders, thrusting a routinely requested authority into the limelight. With the UK’s 2023 proxy season now complete, we’ve observed a decrease in average shareholder support for these proposals.

In this post, we provide background on the changes to best practice guidance for the disapplication of pre-emption rights, insights into their impact on recent voting outcomes and a glimpse of the narratives behind increased instances of significant shareholder opposition.

Background

In July 2022, the outcomes of the UK Secondary Capital Raising Review were published following the launch of the independent review by the Treasury nine months earlier. The review, seeking to improve the efficiency of capital raising operations for companies, resulted in several recommendations to the UK government, the Financial Conduct Authority (“FCA”) and the Pre-emption Group (“PEG”). The PEG, which sets best practice guidance for the disapplication of pre-emption rights in the UK, updated its Statement of Principles in November 2022 to reflect the recommendations of the review.

Updated Guidance

The PEG guidance has increased the limit for an authority to issue shares without pre-emptive rights from 5% to 10%, subject to certain disclosure recommendations (see below). Further, the limit for the additional authority to issue shares without pre-emptive rights restricted to use in connection with an acquisition or specified capital investment has also been increased from 5% to 10%. An additional 2% of issued share capital leeway has been given in respect of each authority in cases where that 2% is restricted to a follow-on offer intended to involve retail and other investors otherwise excluded from the issuance. The PEG calls for further consideration to be made for companies that might be described, and disclose themselves, as ‘capital hungry’.

Part 2B Guidance

The PEG guidance has placed enhanced disclosure requirements on companies seeking to disapply pre-emption rights. Specifically, a company issuing equity securities non-pre-emptively for cash pursuant to a general disapplication of pre-emption rights should:

- prior to announcement of the issue, consult with its major shareholders to the extent reasonably practicable and permitted by law;

- give due consideration to the involvement, in the placing and/or in a follow-on issue as described in paragraph 3 of this Part 2B, of retail investors and existing investors not allocated shares as part of the soft pre-emptive process referred to below;

- explain the background to and reasons for the offer and the proposed use of proceeds, including details of any acquisition or specified capital investment;

- as far as practicable, make the issue on a soft pre-emptive basis;

- involve company management in the process of allocating the shares issued; and

- after completion of the issue, make a post-transaction report as described in paragraph 10 of Part 2B of the PEG guidance.

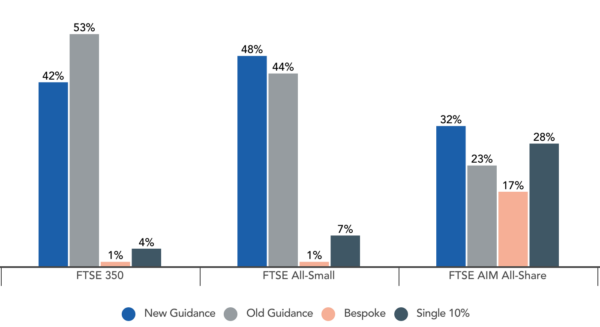

A First Look at the Proposals

The updated PEG guidance was released in November 2022 and, as such, the 2023 AGM season has seen many companies seeking approval for the enhanced authorities. Of the companies in our coverage that sought the disapplication of pre-emption rights (in the year to June 30), 41% utilised the new guidance. There is significant variation in the types of companies seeking authorities in line with the updated guidance, with the FTSE 350, FTSE All-Small and FTSE AIM All-Share each represented in the cohort. Further, there does not appear to be any differentiation by industry, despite some being potentially more capital intensive.

As illustrated above, the FTSE AIM All-Share was the index with lowest uptake in our sample. This likely reflects the significant number of ‘bespoke’ authority limits sought in the market (17%) and the large number of companies which seek 10% authorities on a routine basis (28%). Conversely, the FTSE All-Small featured the highest uptake, which could reflect either weaker financing relative to FTSE 350 peers, or less scrutiny by investors.

Among companies that followed the old guidance, disclosure was occasionally provided on their rationale. Companies generally either claimed to be monitoring the evolution of best practice in this regard over the year or cited a lack of need for enhanced authorities given their capital positioning.

Voting Outcomes

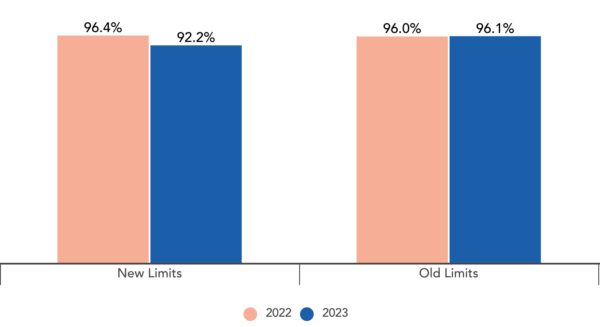

Of the companies who have sought approval for the increased limits thus far this year, there appears to be widespread support from investors.

Nonetheless, of the companies that disclosed vote results for both years, support for the basic disapplication authority has decreased by 4.0 percentage points relative to last year and support for the additional disapplication authority has decreased by 4.4 percentage points.

In total, 19 defeated resolutions in 2023 (2022: 11 in the same period) relate to the issuance of shares without pre-emptive rights at 13 different companies.

With its AGM held on February 16, 2023, Benchmark Holdings plc (“Benchmark”), a FTSE AIM UK 50 listed company, was the first to see shareholders deny approval for the increased authorities, including the additional 2% under each authority. Approximately 55% of shareholders voted against both resolutions related to the disapplication of pre-emption rights and Benchmark stated: “These resolutions were in line with the updated Pre-Emption Group’s Statement of Principles and the Board considers the flexibility afforded by these authorities to be in the best interests of the Company” (RNS Announcement). At this time, while the driver of dissent remains unclear, it could likely relate to the high volume of overseas shareholders, who often object to these authorities when the terms differ from their local market practice. Alternatively, Benchmark’s utilisation in full of its disapplication authorities granted at the 2021 and 2022 AGMs may represent a likely trigger of dissent; shareholders often pay close attention to such proposals where they have previously been utilised.

Similar narratives are true of the other defeated resolutions, with against votes reflecting continued historical dissent or unique concerns such as a major shareholder’s aversity to dilution. Also worth noting is that these defeated proposals sought not only authorities in line with the new guidance, but also the old guidance and some bespoke limits. It is evident that the new guidance in and of itself is unlikely to trigger significant broad shareholder dissent, but public companies should remain mindful of their unique circumstances when seeking the disapplication of pre-emption rights.

Looking for More?

Our 2023 UK Proxy Season Briefing provides a first look at the recent UK AGM season. For an in-depth dive into Glass Lewis’ data and insights, stay tuned for the 2023 UK Proxy Season Review, which will be available to Glass Lewis clients on Viewpoint and Governance Hub in due course.