France’s legislative bodies have been debating the introduction of stricter say-on-pay rules for a the past few months (see blog post), but last Tuesday the final text of the amendment emerged (Amendment 161); its final passage into law awaits only the French President’s signature, which is expected within two weeks.

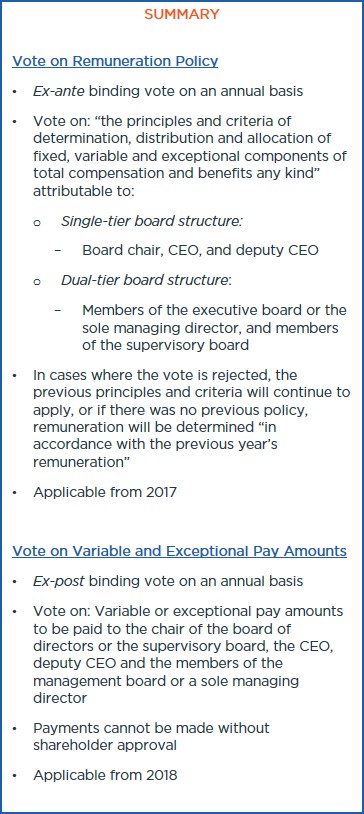

Embedded in an omnibus transparency and economic modernisation bill (known colloquially as “Sapin 2”), this amendment institutes two separate binding votes on remuneration; a forward looking vote on policy, and a backward looking vote on variable and exceptional pay amounts. In terms of timing, the former vote will come into force in 2017, while the latter won’t grace the AGM ballot card until 2018.

More specifically,  the new rules for 2017 include a forward looking, annual, binding shareholder vote on the “principles and criteria of determination, distribution and allocation of fixed, variable and exceptional components of total compensation and benefits any kind”, attributable to the chair, CEO, and Deputy CEO in a single board structure, or to the members of the executive board, the sole managing director, and the members of the supervisory board in a dual board structure.

the new rules for 2017 include a forward looking, annual, binding shareholder vote on the “principles and criteria of determination, distribution and allocation of fixed, variable and exceptional components of total compensation and benefits any kind”, attributable to the chair, CEO, and Deputy CEO in a single board structure, or to the members of the executive board, the sole managing director, and the members of the supervisory board in a dual board structure.

In case of failure of this forward looking vote, the previous principles and criteria will continue to apply or, if there was no previous policy, remuneration will be determined “in accordance with the previous year’s remuneration”.

In 2018, the second binding vote will come into force; for any payment to occur, shareholders will be required to approve the payment of variable and exceptional pay amounts to the chair of the board of directors or the supervisory board, the CEO, deputy CEO, the members of the management board or a sole managing director. The amendment does not specify what recourse issuers may have in case of a failure of this second binding vote.

In instituting binding say-on-pay votes, France follows in the footsteps of the UK and Switzerland, which have already introduced binding votes on remuneration policy and maximum payouts, respectively. It should be noted that neither of these two approaches turned out quite as planned; across the channel in the UK, controversies and questionable pay practices have continued to abound (see blog post), while across the Alps in Switzerland, the populist initiative against “fat cat salaries” failed to prevent the country’s top CEOs from being the highest paid in Europe in 2015.

The Afep and Medef (France’s principal employer’s federations) have yet to issue press releases regarding the final version of the say-on-pay rules. The current version of the Code recommends that companies submit the compensation amounts paid or granted to corporate officers during the year to an advisory vote, but it is still unclear whether such a recommendation will be removed or replaced with another. French issuers are likely to be hopeful of clear guidance from the Code, given that the rather vague language of the amendment could be a source of considerable confusion in the coming proxy seasons.